ITC: Assessing the Growth Potential of India’s FMCG Giant

The leading FMCG company in India, the second largest hotel chain, and a clear leader in the paperboard and packaging industry as well, ITC has shown immense growth over the years. With an excellent past growth trajectory and a future potential for more growth, it is among the best companies individuals can trade and invest their resources.

Are you curious to know the growth trajectory of this FMCG giant? Read on as we discuss its growth patterns over the years.

ITC Growth Strategy

While ITC manufactures cigarettes, it aims to build multiple drivers of growth in the non-cigarette segment.

ITC works with a three-fold growth framework that focuses on reinforcing core businesses and working on emerging ventures such as nicotine, beverages, frozen foods, etc. Lastly, the company also has investments in growing avenues such as food tech and skincare. All these segments together build a foolproof strategy for ITC’s growth.

When considering the numbers for ITC, the Return on Capital Employed for the non-cigarette segment has seen a growth from 14.3% in FY13 to 21.7% in FY23.

Price Analysis of ITC

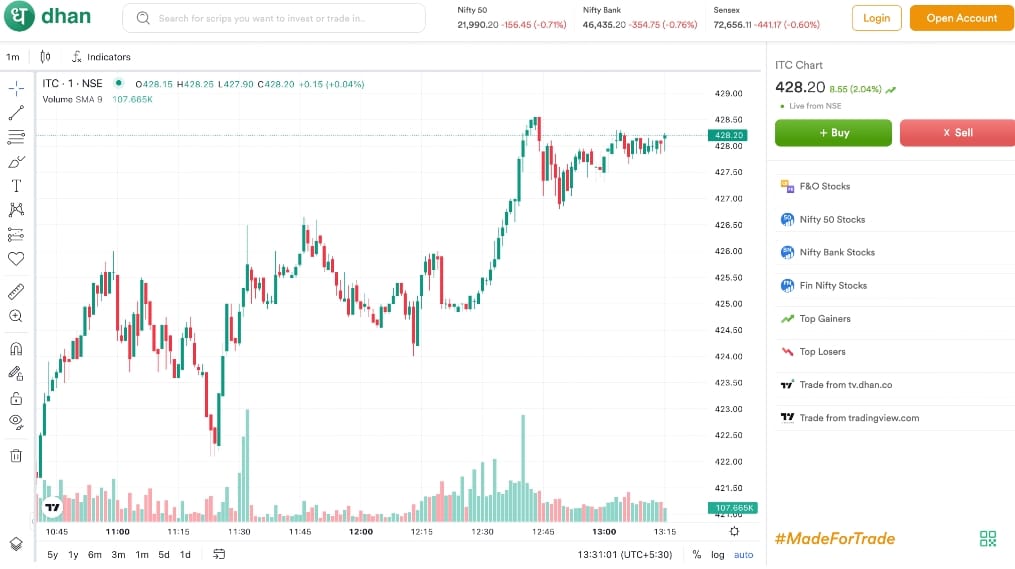

As of March ‘24 ITC share price is around ₹ 420+ with the company’s market capitalization at ₹ 5,14,486.00 with a P/E ratio of 25.00. The past year has seen a growth of 5.59% in the share price and the five-year growth of the stock is 45.05%. Here is the ITC share price chart:

One of the major contributors to the growth of ITC is the steady growth of the FMCG industry itself. ITC aims to expand the EBITDA margin by 80-100bp pa with the internal division of product mix and premiumization ~30bp, scale advantages ~20bp, and cost optimization ~30bp.

Additionally, the other FMCG businesses’ EBITDA margins also saw a rise of 770 bps over FY 2017-23 to stand at 10.2% in FY2023. When comparing ITC with other FMCG giants such as Nestle and Hindustan Unilever Ltd., ITC stock has performed well.

Should You Invest in ITC?

ITC over the years has performed well. The core reason why ITC is expected to grow is owing to its portfolio including a range of FMCG products.

ITC has witnessed consistent gains across its main brands and products and further aims to enhance its hotel business. These are other contributors to the growth and the success of ITC. As a result, this stock has become quite popular among investors.

Whether or not you should invest in this stock depends on your existing portfolio and risk appetite. Identify those parameters and make an informed decision on whether you want to invest in ITC and what goals are you trying to achieve.

Conclusion

ITC has shown tremendous growth over the years and promises good future growth as well. Investors seeking to invest in an FMCG company with good returns potential can consider ITC as an option.